How Does Mortgage Company Verify Employment . Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is. To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your initial 1003 loan application. Your lender confirming your employment status will. They don’t usually check your employment after closing, but they may in some cases. Verification of employment is an important part of the mortgage process. Once you have signed your initial disclosures, the loan processor will likely. Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. How do mortgage lenders verify employment and income? How does a mortgage processor verify employment?

from templatelab.com

To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your initial 1003 loan application. Your lender confirming your employment status will. Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. They don’t usually check your employment after closing, but they may in some cases. How does a mortgage processor verify employment? Verification of employment is an important part of the mortgage process. How do mortgage lenders verify employment and income? Once you have signed your initial disclosures, the loan processor will likely. Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is.

40+ Verification Letter Samples (& Proof of Letters)

How Does Mortgage Company Verify Employment Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. They don’t usually check your employment after closing, but they may in some cases. Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is. Verification of employment is an important part of the mortgage process. How do mortgage lenders verify employment and income? How does a mortgage processor verify employment? Once you have signed your initial disclosures, the loan processor will likely. Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your initial 1003 loan application. Your lender confirming your employment status will.

From www.pinterest.com

Mortgage Employment Verification Form How to create a Mortgage How Does Mortgage Company Verify Employment How do mortgage lenders verify employment and income? Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. To prove your employment, the first thing you’ll need to do is fill out all of your employment information on. How Does Mortgage Company Verify Employment.

From www.dochub.com

Verification of employment for mortgage template Fill out & sign How Does Mortgage Company Verify Employment Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. Your lender confirming your employment status will. To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your initial 1003 loan application. Mortgage lenders usually verify income and employment by contacting a borrower’s employer. How Does Mortgage Company Verify Employment.

From www.signnow.com

Verification of Mortgage 19982024 Form Fill Out and Sign Printable How Does Mortgage Company Verify Employment Once you have signed your initial disclosures, the loan processor will likely. Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is. How do mortgage lenders verify employment and income? Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing. How Does Mortgage Company Verify Employment.

From www.visme.co

Company Employment Verification Letter Template Visme How Does Mortgage Company Verify Employment Once you have signed your initial disclosures, the loan processor will likely. How does a mortgage processor verify employment? To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your initial 1003 loan application. They don’t usually check your employment after closing, but they may in some cases. Mortgage lenders. How Does Mortgage Company Verify Employment.

From adityaandii.blogspot.com

Letter Of Employment For Loan Canada Confirmation of Employment How Does Mortgage Company Verify Employment Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. Once you have signed your initial disclosures, the loan processor will likely. How does a mortgage processor verify employment? How do mortgage lenders verify employment and income? Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. Verifying. How Does Mortgage Company Verify Employment.

From ar.inspiredpencil.com

Employment Verification Letter Sample For Apartment How Does Mortgage Company Verify Employment How do mortgage lenders verify employment and income? Verification of employment is an important part of the mortgage process. Your lender confirming your employment status will. Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. Once you have signed your initial disclosures, the loan processor will likely. How does a mortgage processor verify. How Does Mortgage Company Verify Employment.

From sprqtax.blogspot.com

Employment Verification Letter Sample Three Main Needs of the How Does Mortgage Company Verify Employment Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. How do mortgage lenders verify employment and income? How does a mortgage processor verify employment? They don’t usually check your employment after closing, but they may in some cases. Your lender confirming your employment status will. To prove your employment, the first thing you’ll. How Does Mortgage Company Verify Employment.

From www.youtube.com

Employment verification letter for Home loan / Mortgage Employment How Does Mortgage Company Verify Employment How do mortgage lenders verify employment and income? How does a mortgage processor verify employment? Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is. They don’t usually check your employment after closing, but they may in some cases. Mortgage lenders usually verify income and. How Does Mortgage Company Verify Employment.

From templatediy.com

Remote Work Verification Letter Sample Template Examples How Does Mortgage Company Verify Employment How does a mortgage processor verify employment? Verification of employment is an important part of the mortgage process. How do mortgage lenders verify employment and income? Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. Once you have signed your initial disclosures, the loan processor will likely. Your lender confirming your employment status. How Does Mortgage Company Verify Employment.

From www.pinterest.com

Request For Verification Of Employment Mortgage refinance calculator How Does Mortgage Company Verify Employment Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. How does a mortgage processor verify employment? Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. Once you have signed your initial disclosures, the loan processor will likely. Verifying employment is a crucial step in determining a. How Does Mortgage Company Verify Employment.

From www.vrogue.co

Sample Employment Verification Letter Template For Yo vrogue.co How Does Mortgage Company Verify Employment Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is. To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your initial 1003 loan application. How do mortgage lenders verify employment and income? How does. How Does Mortgage Company Verify Employment.

From nasioletter.blogspot.com

Letter Of Employment Template For Mortgage Canada Cover Letter How Does Mortgage Company Verify Employment Verification of employment is an important part of the mortgage process. How do mortgage lenders verify employment and income? Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. Your lender confirming your employment status will. Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the. How Does Mortgage Company Verify Employment.

From www.pdffiller.com

2005 Form Capital Alliance Request for Verification of Rent or Mortgage How Does Mortgage Company Verify Employment Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is. They don’t usually check your employment after closing, but they may in some cases. To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your. How Does Mortgage Company Verify Employment.

From templatelab.com

40+ Verification Letter Samples (& Proof of Letters) How Does Mortgage Company Verify Employment How does a mortgage processor verify employment? Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. To prove your employment, the first thing you’ll need to do is fill out all of your employment information on your initial 1003 loan application. Once you have signed your initial disclosures, the loan processor will likely.. How Does Mortgage Company Verify Employment.

From www.examples.com

Employment Verification Letter 17+ Examples, Format, Word, Google How Does Mortgage Company Verify Employment Verification of employment is an important part of the mortgage process. Your lender confirming your employment status will. Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. How do mortgage lenders verify employment and income? They don’t usually check your employment after closing, but they may in some cases. To prove your employment,. How Does Mortgage Company Verify Employment.

From www.docformats.com

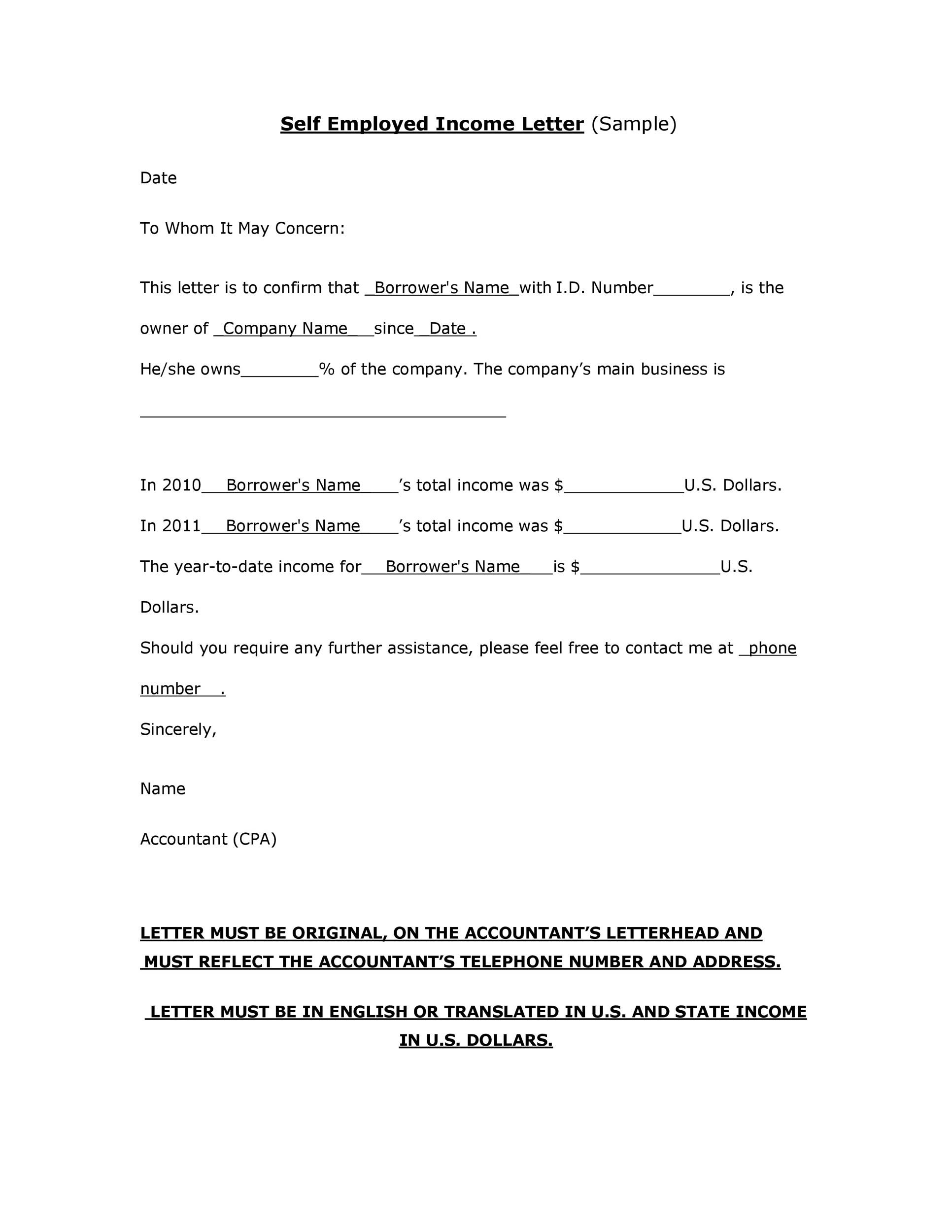

Verification Letter for SelfEmployed (Samples & Templates) How Does Mortgage Company Verify Employment Your lender confirming your employment status will. They don’t usually check your employment after closing, but they may in some cases. Verification of employment is an important part of the mortgage process. Once you have signed your initial disclosures, the loan processor will likely. How do mortgage lenders verify employment and income? How does a mortgage processor verify employment? To. How Does Mortgage Company Verify Employment.

From www.rallylegal.com

Employment Verification Letter Rally Legal How Does Mortgage Company Verify Employment Your lender confirming your employment status will. Verifying employment is a crucial step in determining a borrower's creditworthiness, reducing fraud risk, and ensuring that the loan will perform, where the loan is. They don’t usually check your employment after closing, but they may in some cases. How do mortgage lenders verify employment and income? How does a mortgage processor verify. How Does Mortgage Company Verify Employment.

From www.vrogue.co

Sample Employment Verification Letter For Immigration vrogue.co How Does Mortgage Company Verify Employment Verification of employment, along with relevant tax and financial documentation, helps reassure mortgage companies that their. How do mortgage lenders verify employment and income? How does a mortgage processor verify employment? Mortgage lenders usually verify income and employment by contacting a borrower’s employer directly and reviewing recent. Once you have signed your initial disclosures, the loan processor will likely. Your. How Does Mortgage Company Verify Employment.